Case Study: How One Construction Company Saved $1M in Taxes

Last updated August 2020

By Ryan Niadoba, President at NB Advisors

I first met Jim Lupinetti of One Creation Construction on his job site, while he was in the midst of framing a 2,600 square foot cape cod in an idyllic New Jersey neighborhood across from the park. Guys were running around, lumber was laying everywhere.

Jim had several homes actively being built and dozens more on the horizon. He proceeded to tell us how his business was doubling in size every year. How his team was handling the growth, but how he couldn’t stand that his accountant would never return his phone calls, especially with pending tax returns.

See, Jim’s accountant used to be good. He would call back immediately. Jim always knew when his work was getting done, he understood what the accountant did and why he did it.

Unfortunately, Jim’s accountant became more focused on his own retirement than on helping Jim. Despite being very loyal, Jim had grown frustrated and the time to make a change was now.

Sound familiar?

What Good Accountants Do…

So we asked Jim.

Our CPA firm’s policy is to return all customer phone calls/emails within 24 hours, with no exceptions. Is that something that would put your mind at ease?

“Yes.”

And every single project we do for a customer has a known completion date, in advance, approved by you, the client. Would you like that?

“Yes.”

Also, we price all of our services upfront so you know exactly what our bill will be and can make a decision on if you want us to proceed with the work. Does that sound fair?

“Absolutely!”

So are you interested in making the transition to our Construction Accounting firm?

“I am.”

At this point, we requested the prior two years of tax returns and access to his books, so that we could evaluate what exactly needed to be done for us to help One Creation Construction.

$1M in Tax-Savings PLUS $1.2M in Profits

Once we dove into Jim’s records, we unearthed a mountain of opportunity! Specifically:

- We felt that we could substantially reduce his tax liability (assuming no growth) by nearly $250k over a decade. If he continued to grow at half of his current rate, we would be able to save in excess of $1M.

- We identified a significant opportunity for risk reduction. Certain corporate structures are considered “high-risk” to be audited by the IRS. By restructuring his company, we were able to reduce his audit risk by 90%.

- As specialists in the home building space, we identified areas for increased profitability that would increase his income by nearly $70,000 in year one and would result in an additional $1.2 million in profits over the course of a decade.

But you’ll be surprised by Jim’s response…

Accountants Miss This All The Time!

As we met with Jim and reviewed these opportunities, we could see he was growing a bit upset.

Upset?!

We took the opportunity to ask him why.

To which he replied: “I just do not understand how my accountant could have missed all of these things for so long. I am so happy I met you guys, but so pissed that I never knew all this!”

We explained to Jim that this is something we see all the time because:

- Most accounting firms are “generalists”. They work with anyone in any type of business. They will work with lawyers, doctors, manufacturing, restaurants, websites, etc. They are “jacks of all trades and masters of none”. We are construction accountants and exclusively work with home builders or construction companies. We know the building industry better than most. Plus, we never get stretched thin by having to “keep up” with IRS tax law for other industries (professional services, manufacturing, etc).

- Many accounting firms feel their job is to “do your taxes”. It is a lazy business model. They never look for ways for you to improve. One of our core values as a business is to always seek ways for our customers to improve.

- For the accounting firms that do find ways to improve. They often do a poor job of explaining why changes should be made and what the benefits are. As builders ourselves, we know what is important to you and can explain in plain English why to do it.

- Many accountants never propose new ideas because they are afraid that you will not want to pay for these changes. As I mentioned to Jim in the field, all these changes will be priced upfront and it is “ok” for Jim to say “no”. We will never make that decision on his behalf.

In our first year of working together, we were able to save Jim over $100k in taxes. We have restructured his business to reduce the likelihood that he would be audited.

How’d we do it?

Without going into all the eye-glazing details, here’s a high-level overview what we did for Jim:

- Corporate Structure. We reviewed the actual corporate structure that Jim’s business was set up with. There are many different kinds (sole proprietorships, corporations, s corporations, partnerships, UBO, etc) and they all have different tax treatments. Depending on the business, some are better suited than others. We elected to change his structure for significant tax and risk management benefits.

- Tax Minimization. We evaluated what tax laws, deductions, and deferrals could be utilized to minimize his tax bill. The US tax code is the second most complex in the world (#1 is Brazil). We have an extensive review process to identify missed and underutilized tax minimization opportunities.

- Benchmarking Profitability. As certified NAHB trainers we evaluate the profitability of all our customers and compare how they are doing to the rest of the home-building or construction industry. We commonly see new home builders with gross profitability of 10%-15% when they should be closer to 25% to 28%. There are many factors that can lead to this: lack of knowledge, confusing mark-up and margin, not tracking project costs, etc. We were able to determine that Jim (while very profitable) had room for improvement and have been advising him on strategies to increase profits.

We are now focused on helping him grow and look forward to seeing the results happen.

P.S. Is Now The Time For You To Switch Accountants?

You could stick with your current accountant, and potentially give $1Ms more to the IRS and lose even more in profits.

Book a free consultation now because fairly quickly, in plain English, I tell you whether:

- Your current accountant is dropping the ball by leaving $100K to $10M on the table for the IRS, your company structure is a high-risk for an audit, and you’re missing opportunities for profits. Or….

- In the rare cases, we discover your accountant is doing an awesome job with your taxes, company structure, and growth strategy.

If you’d rather not, I understand, I appreciate you reading this far!

About The Author

Do You Know Anyone Who Could Benefit From This Case Study?

Because I’d really appreciate you sharing this case study with your home-builder and construction industry colleagues, family and friends.

Consult with a Home-Builder & Construction Tax Specialist Today.

One of my CPA clients, Steve Cook, put it to me like this “If you wait for referrals, you’ll starve.”

Never go hungry again and take control of your client growth like Jerry did…

700 people monthly were searching for Jerry’s CPA practice

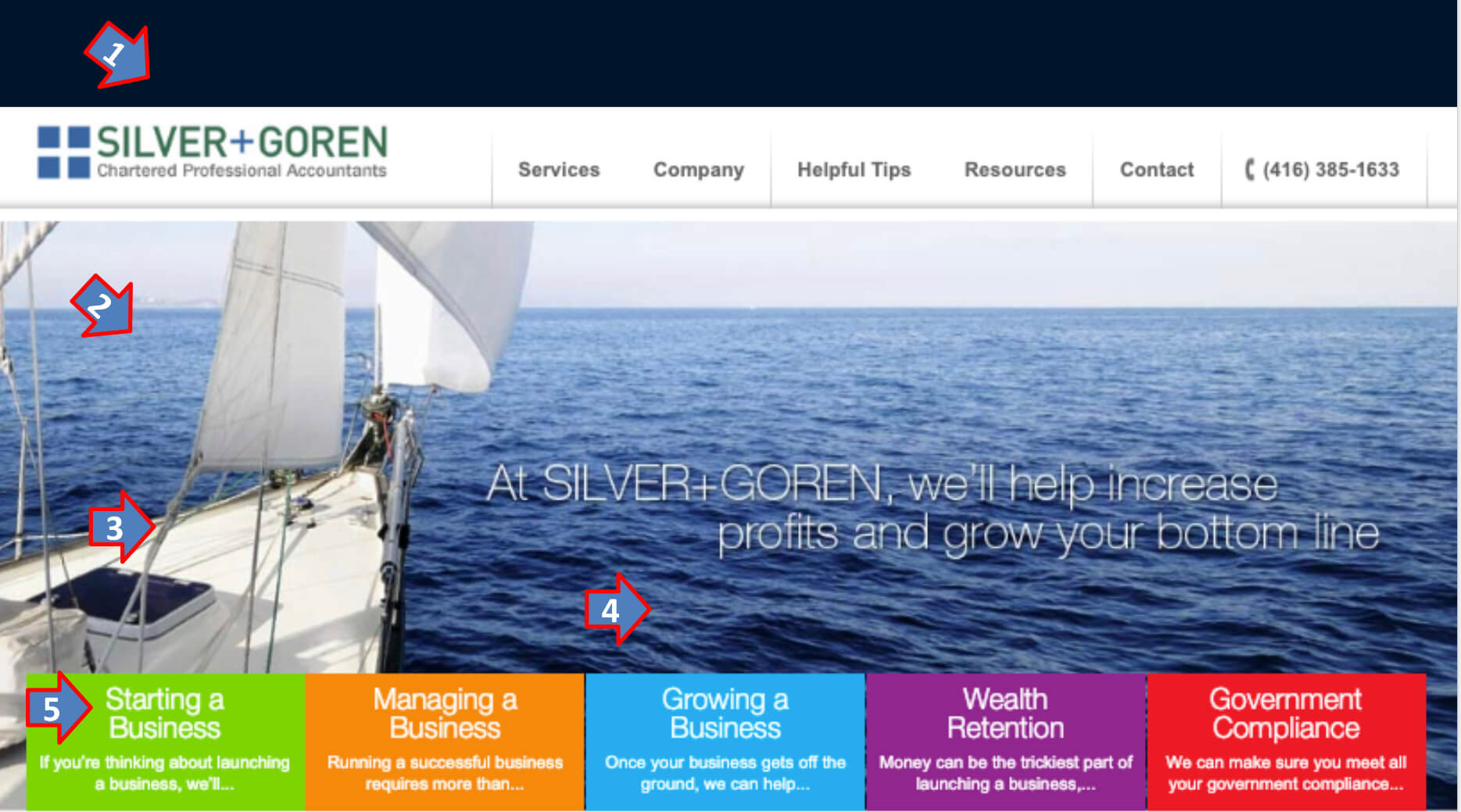

Over two years ago, I offered Jerry Silver, CPA (picture above) our lead generation services.

The first thing he said to me was “JP, I’ve been in business for 35 years, and I built it on networking. Advertising has never worked for us.”

Sound familiar?

To which I replied, “You’re right Jerry, advertising doesn’t work. What I’m suggesting is a digital lead generation system.”

Jerry: “I’m listening.”

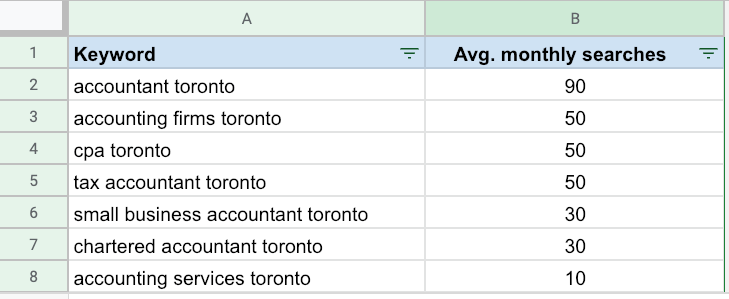

I went on to share that “700 people are searching for your Toronto accounting services every month.”

I love spreadsheets, you love spreadsheets, so I’ll share some of this keyword research from Google.

By the way, I’ve done the research in almost every major city in North America, and 100s even 1000s of business owners are searching for “accountant” every month whether you’re in LA, NYC, or Philly.

What you’ll learn in this accountant case study about:

- Metrics for measuring marketing success

- A lead generation marketing blueprint for success

- Mistakes accountant websites make

- What makes a successful accountant

- Search engine marketing basics

- Why “SEO” is the lowest cost per lead

- How to calculate ROI on marketing

Our Top 10 Successes

Here are the successes over the last two years working with Jerry:

-

-

- Within 3 days of launching, we had our first prospective client call.

- By month two, I got an email from Jerry stating “Thank you for the help. The quality of the leads are quite good, not all of them have worked out, but a lot have become clients.”

- 60-70% of the leads (web forms and calls) would come in for appointments. 60-70% of appointments would become clients. Thus, between 36% and 49% of “leads” would become clients.

- Our average leads were 24 a month.

- 43 was the most leads in a month!

- 10.2 is the average amount of new clients in a month.

- 21 was the most new clients in a month

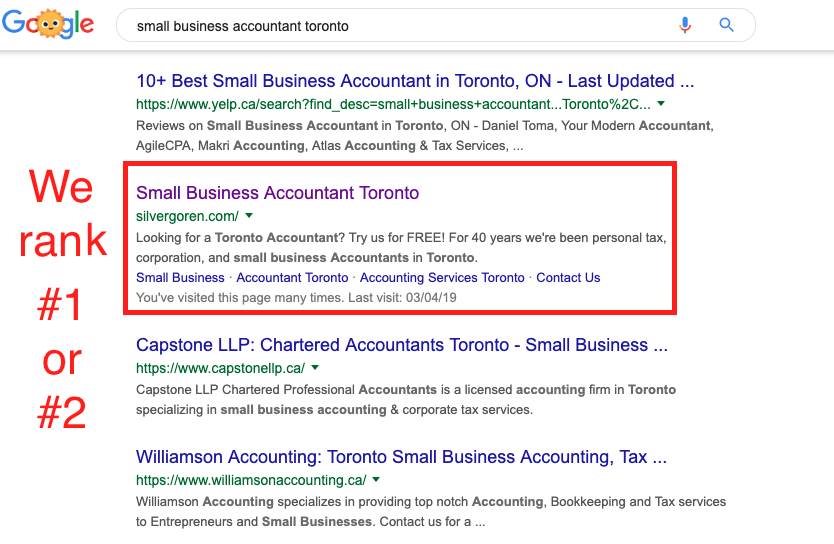

- We rank #1 or #2 for “Small Business Accountant Toronto”

- We rank #3 for “Tax Accountant Toronto”

- From 0 new clients through marketing to 10.2 new clients monthly is 1,020% client growth!

-

We’re proud of the work we’ve done with Jerry and our CPA clients.

What about referrals?

I’m not knocking referrals, they’re great, but referrals are unreliable

When I was co-founder of Booty Camp Fitness, a women’s only fitness company, we surveyed over 1,000 clients and found over 55% of our clients came to us from a referral from a friend. Without those referrals no way we could have grown from $0 to $10M in revenue in 4 years.

But without initial client growth strategies (marketing) to get those initial clients, who would refer us in the first place? It’s a chicken and the egg scenario, and I say marketing is the egg that grows your business.

Here’s how you can grow your accounting practice…

How’d we do it?

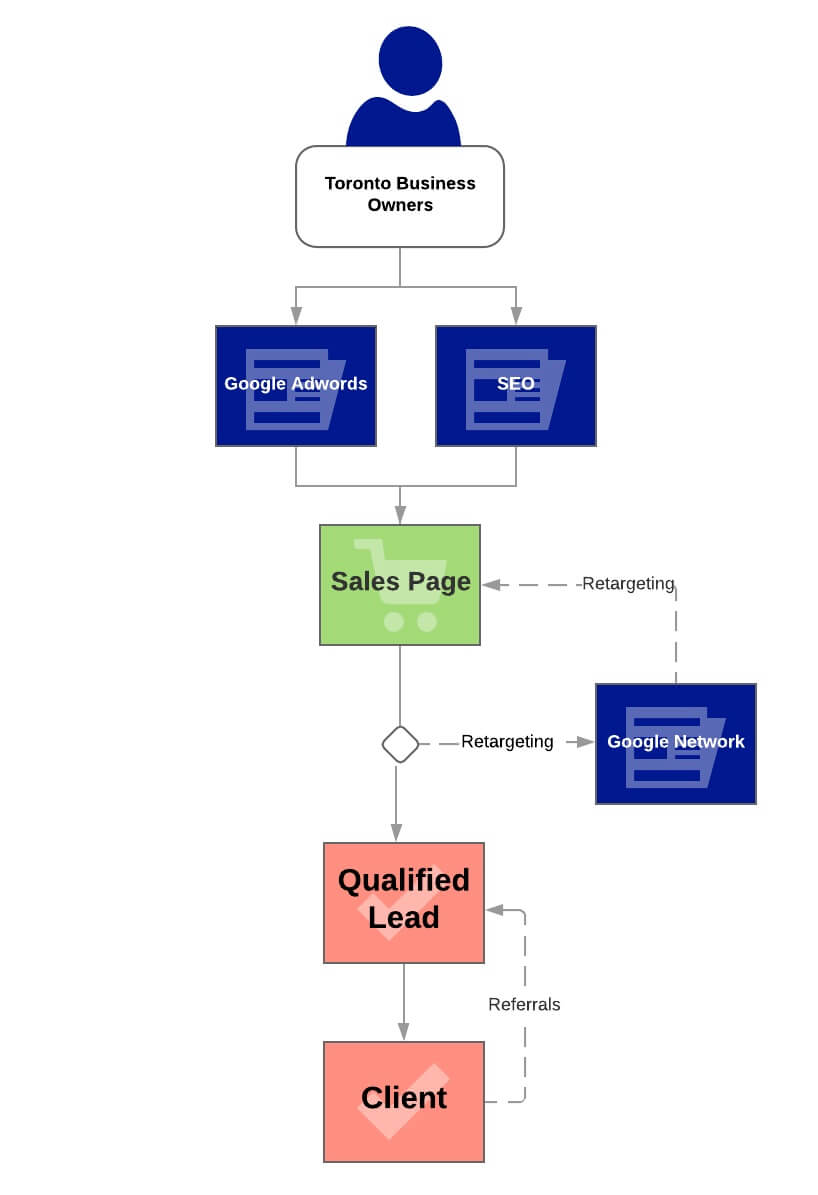

To achieve the above “successes”, we simply:

-

-

- Created a high converting website (“sales page”)

- Attracted targeted web traffic (Toronto business owners) through Google AdWords and SEO

-

This is our “Accountant Lead Generation Blueprint” below:

Let’s go over the first part of a “sales page” below…

Does your website make these mistakes?

Like Jerry’s website, most accountant websites are functional and corporate:

-

-

- No pictures of themselves or their team

- No marketing fluff (benefits to working with them, testimonials, etc)

- A phone number and maybe a tax prep form

-

The mistakes are failing to give people what they NEED to choose your CPA practice. People want to:

-

-

- Work with people, which means photos of you on your website or very least a stock photo of people

- Know why working with you is better than a bookkeeper, their family member that does taxes, or TurboTax

- Know it’s FREE to have a consultation with you because most don’t know that

-

A successful Accountant website looks like…

One of my favourite quotes about website design is:

“The best design isn’t the one that makes your company look cool, edgy and sophisticated. It’s the design that supports conversion, has room for good copy, and powerful calls to action that make people click the big button.”

— Brian Massey of Conversion Sciences

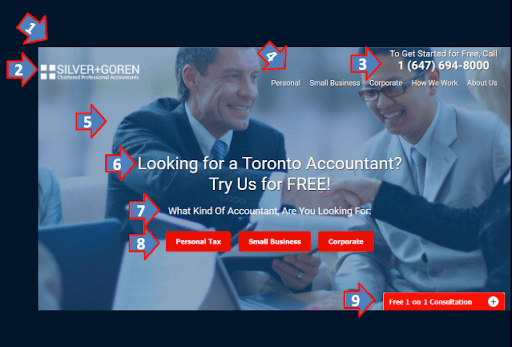

Jerry’s website is about getting prospective clients to click the BIG RED BUTTONS.

Here’s what Jerry’s looks like:

Here’s why it works:

-

-

- Responsive Design. Scales sizes for small screens like mobile devices or for larger screened monitors.

- Logo. Large brand recognition, but intentionally white and UNclickable to avoid being clicked on and drawing minimal attention.

- Call Now. Right at the top is our most important Call To Action (CTA): Call Now!

- Nav Bar. Focuses on identifying visitor. Minimal size to deemphasize.

- Photo. Big and stands out. People want to work with PEOPLE, not “boats”:) Since Toronto and Jerry’s clients are diverse and multicultural, we included a man of Asian heritage and a woman.

- Headline. Visually the largest. Speaks to what the visitor is looking for “an Accountant” and LOCKS in user with “FREE”.

- Sub-Headline. Supports the headline and asks the visitor to tap a button.

- Call-To-Action (CTA). Focuses on the visitor to select what they are looking for: personal tax, small business, or corporate.

- CTA. Focuses on a FREE consultation. Static (moves up and down page with the user).

-

Here’s our ENTIRE website conversion strategy:

Great we have a website that converts visitors into clients, but we need prospective clients visiting the website.

If a website is posted online and no one visits it, does it exist?

Google is King

An astounding 86% of all American consumers regularly utilize an internet search for local businesses that match their particular wants and needs.

The internet is where we will find people searching for your Accounting Practice.

They’re searching because they’re:

-

-

- Having tax problems

- Having tax problems.

- Having tax problems!

- Fed-up with their accountant failing to call them back

- Setting up a new business

-

Google is where you need to appear in front of prospective clients and offer your expertise because Google is the MOST POPULAR website in the US and the World.

But how?

Search Engine Marketing (SEM) 101

Here are a couple of SEM basics:

-

-

- Google, Yahoo, and Bing are search engines.

- A “keyword” is defined as: “a word used in an information retrieval system to indicate the content of a document.” Basically, a “keyword” is the words/phrase you type in the search field of Google when you are searching for some information.

-

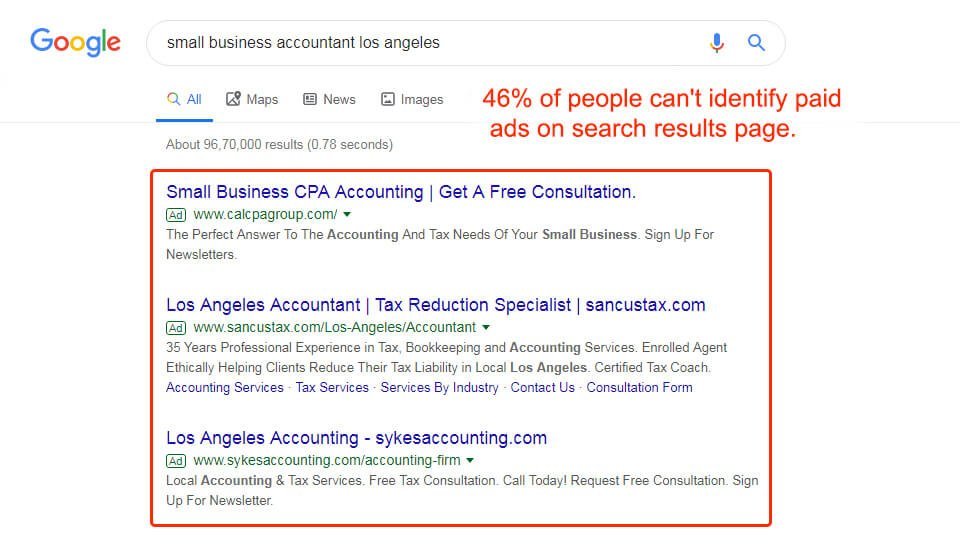

When searching for a CPA most business owners will type into Google “small business Accountant” as their “keyword”.

Clear? Let’s move on.

Google AdWords

AdWords is Google’s sophisticated advertising platform.

Fun fact:

-

-

- In 2018, 85.1% of Google’s $136B in revenue came from search engine advertising.

- That’s right, those top ads at that Google generate $116B in revenue!

-

I know what you’re thinking…

Who the heck clicks on those ads at the top of the Google results?

According to eMarketer, 46% of people can’t identify paid ads on the search results page.

For over 15 years, I’ve been a Certified Google AdWords Professional and Google Partner because Google AdWords is great:

-

-

- You can add 100s of keywords

- Within a couple of hours, you can have people coming to your site

-

Best part of Google Adwords is you only pay for clicks on your ad and the people that come to your site. When you’re more sophisticated with Adwords you can optimize to pay just for people that become leads (call you or book an appointment online).

But Google AdWords isn’t enough

I wish Google AdWords were enough, but it isn’t.

According to PowerTraffick, businesses make on average $3 in revenue for every $1.60 they spend on AdWords. That means your ROI off Adwords is 53.3%.

As a best practice, most businesses invest 20% of their budget on marketing, which creates a 500% ROI. Thus for every $1 spent on marketing you should generate $5 in revenue.

So how do we get Jerry 500%+ ROI?

This is where SEO (search engine optimization) comes in. SEO is the art and science of appearing in Google for free, the section just below the “ads”.

SEO isn’t a scam, it’s the lowest cost per lead (CPL)

“SEO” is probably the most spammed acronym in the history of our planet – yuck.

But I’m here to tell you, it’s a legit practice of generating leads.

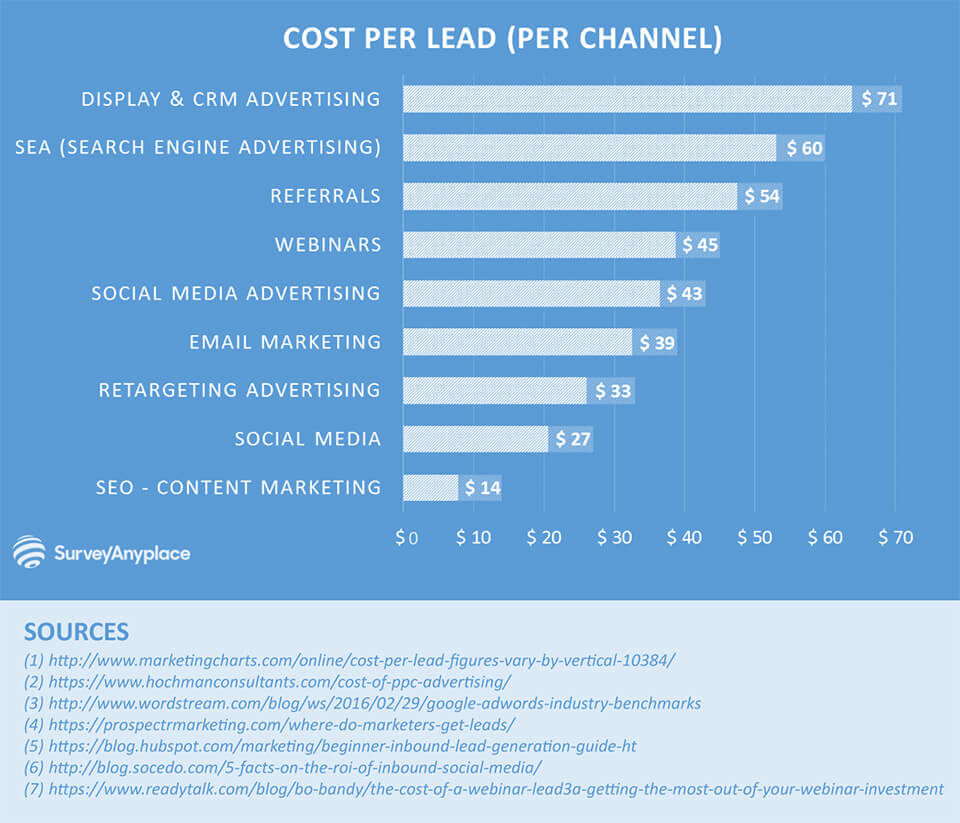

According to AnalyzeSurvey, SEO’s cost per lead (CPL) is $14, which is the lowest of the channels.

How to calculate your cost per lead (CPL)?

For example: consider your company spent $3,000 on a Google AdWords (“SEA”) campaign and 50 visitors converted to leads, then your cost per lead is $3,000/50, which equals $60 per lead.

Adwords VS SEO

If SEO is so much cheaper than AdWords, why do Adwords at all?

Simple: impatience.

Our clients want results today or at the very least, within a couple of months. Basically, we start with Adwords, so our accountants get leads quickly.

SEO can take months to rank in the top 5 because Google’s algorithm and their data centres are set-up to slow the ascent of websites to the top of the search results.

There are two other advantages to AdWords:

-

-

- You can optimize for 100s of keywords, whereas SEO maybe you optimize for 5-20 keywords to rank in the top 5.

- AdWords analytics gave us data that proved “Small Business Accountant Toronto” keyword was the highest converting keyword.

-

As mentioned we rank #1 or #2 for “Small Business Accountant Toronto”. It took us 6 months to rank in the top 5! See our ranking report for Jerry.

Here’s how digital lead generation impacts the bottomline…

What’s the ROI?

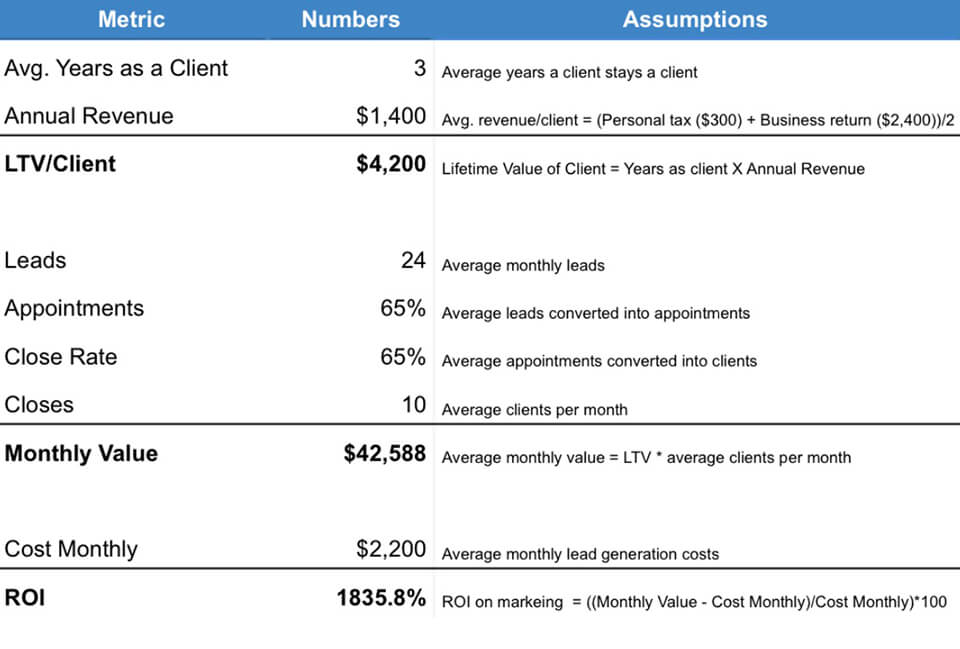

I must be the bravest man alive to be presenting a ROI calculation to a bunch of accountants, but here goes:

1,835.8% is an impressive ROI on marketing, and I think the reason for the high ROI is because:

-

-

- As lead generation experts with 15 years of experience, we’re good at what we do

- Jerry was very patient in giving us the time to adjust and correct

- Very few accountants promote themselves effectively or at all

-

Here is the spreadsheet of the ROI calculator, so you can make a copy and then adjust the numbers for your business.

Let’s get into action!

Do it yourself or hire someone that can.

You could do this yourself: Learn WordPress, learn AdWords, learn SEO, and make all the mistakes and take all that time.

Or you could simply hire us, we’ll do it right, and we’ll make grow your new clients by 1,020% with a 1,835.8% ROI like we did for Jerry.

Do your best and outsource the rest by booking your free consultation now. If you’d rather not, I understand. I appreciate you reading this far!

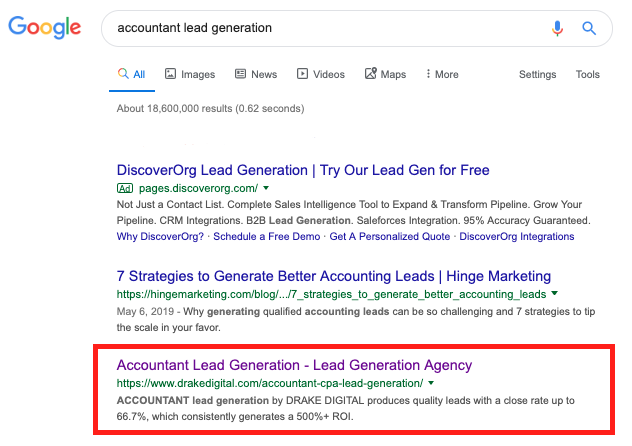

P.S. We’re #2 for “Accountant Lead Generation”

We currently ranked #2 in Google for “Accountant Lead Generation” out of 18,600,000 results.

Why? Because:

-

-

-

- We create 1,020% client growth and 1,836% ROI for Accounting Firms.

- We do it better than anyone else.

-

-