Outsourced Philadelphia CFO Services – Increase Your Profits by 954.9%?

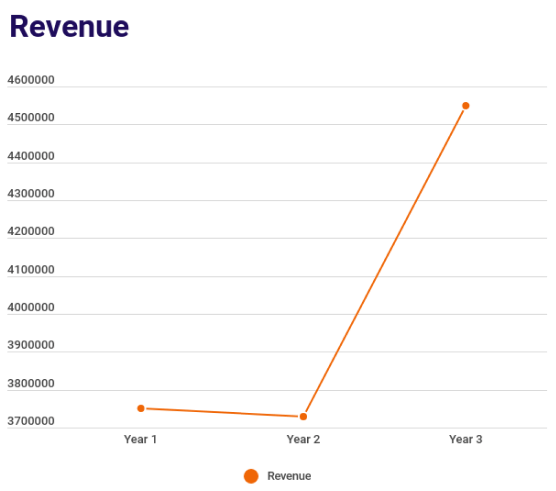

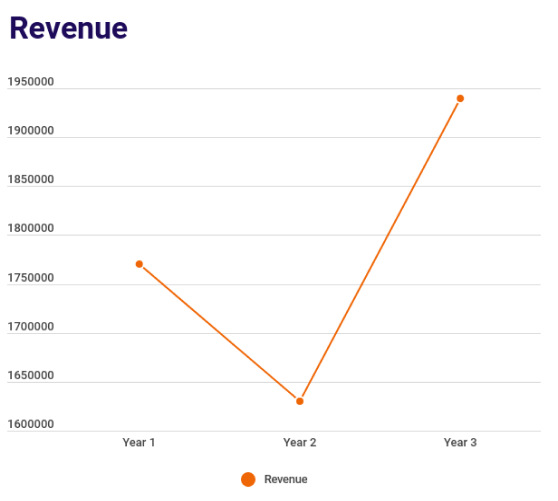

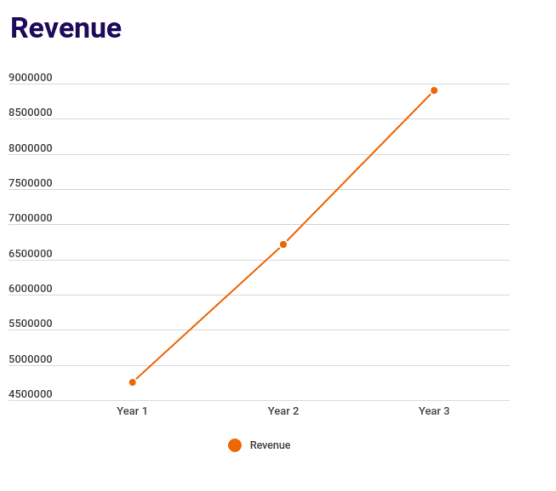

For 35+ years, we’ve been providing premier CFO virtual services for American business owners, and we’re damn-good at what we do. On average, we increase revenue by 40.1% ($2.3M) and profits by 954.9% ($1.8M) over 3 years.

Serving the Philadelphia area’s 1.6 million residents and 200,000 small to mid-size businesses spanning Belmont, Fairmount, Fishtown, Logan Square, Old City, Rittenhouse Square, and beyond for all of your Philadelphia small business accountant needs.

How One Small Business Owner in Philadelphia Unlocked $1M in Capital

Discover How 3 of Our Clients Benefitted From Our CFO Advisory Services

By teaming up with us and receiving insightful data and creative strategic solutions, the following three clients were able to make better decisions and increase their profits substantially (avg 954.9%).

CFO = 10x Revenue & 4x Profits

We analyzed the financials of our outsourced CFO clients and found…

Companies that did not use CFOs

- Their average annual revenue was $1.2M

- Their average annual profits were $310K

- Worst of all, these Business Owners were prone to working 60+ hour work weeks

Companies that used an outsourced CFO

- Their average annual revenue was $10.7M

- Their average annual profits were $1.1M

- Best of all, the Owners worked less as they relied on their teams and employees to achieve results

Our CFO Services Are Perfect for You, IF…

You don’t know what a CFO does?

- If you’re trying to grow your business without a CFO (Chief Financial Officer) it would be like trying to fly from NYC to LA, but without any instruments or a map.

- As your CFO, we’ll act as your navigator and strategically guide you through the financial data to help you (the CEO) pilot the company to your revenue goals.

- Note, a CFO (Chief Financial Officer) is not just another accountant who calculates numbers; a CFO is a partner who communicates the prioritization of creative solutions.

You realize you need a CFO

- You want a CFO to alert you to foreseeable trouble (cashflow), make financial decisions (on labor costs), and “gut check” your decisions, but…

- You can’t justify the $150,000 to $500,000 salary of a full-time CFO.

- The solution is our on-demand CFO services because we can provide the high-level strategic advisory required to achieve your growth goals, but at a fraction of the cost of a salaried executive.

4th Generation Small Business Owners & Accountants

My grandfather was an Accountant and my other grandfather was in the insulation manufacturing industry. Doing great accounting work is in my blood.

Since 1989, my father (Kevin Niedoba), a small business accountant of 30+ years founded our family accounting firm. A few years back, I decided to split my time as a small business owner and join him because I’m passionate about both accounting and entrepreneurship. I hope one day my son, William, will also join the business (if he wants to, he’s only 3 years old).

We’ll treat your business like it’s our own, by taking advantage of every possible legal tax minimization and profitable growth opportunity we can, all the while minimizing risks.

On behalf of my family and our amazing team at NB Advisors, I look forward to working with you to grow your business.

Ryan Niedoba | NB Advisors

Managing Partner

Kevin Niedoba, CPA | NB Advisors

Managing Partner

Trusted by Philadelphia Small Business Owners

Why Only 6% of Businesses Grow by 300%

Did you know that only 6% of businesses set annual goals and revisit them on a quarterly basis?

This is according to Xero’s (second largest accounting software) “Make or Break” report, which goes further to share that the 6% of business owners that “revisited” their goals quarterly had an increase of 300% in both productivity and performance.

Our Claimed Awards

2018

NJBA:

Best Online Interactive Tool Award

2016-17

SNJBP:

Readers’ Choice Award

2016

NJBA:

Sales and Marketing Excellence Award

2015

Thomson Reuters:

The Rookie of the Year Award

Photo Credit:

Thomson Reuters. Ryan Niedoba (middle) and Kevin Niedoba (right).

Our Claimed Awards

2018

NJBA:

Best Online Interactive Tool Award

2016-17

SNJBP:

Readers’ Choice Award

2016

NJBA:

Sales and Marketing Excellence Award

2015

Thomson Reuters:

The Rookie of the Year Award

World Class Philadelphia Controller Services

Our Growth Playbook

We have the exclusive North American license to “Game Plan”; a proprietary management accounting tool.

With this tool, we’ll quickly analyze 100s of financial data points

and produce a report with 13 metrics to predict your company’s health, risk factors both short and long term, and likelihood of bankruptcy.

As certified tax professionals, we’ll evaluate your business’ profitability and compare it to the rest of your company’s industry.

We commonly see companies with gross profitability of 10%-15% when they should be closer to 25% to 28%.

Our focus is on making our customer’s business better, faster, and stronger. This is done via our annual firm-wide “Awesome 8” review and by working with businesses on:

- Growth: Strategies to increase revenue and size of the business.

- Profitability: How to yield more profit per dollar.

- Cash Flow: Better manage cash flow (highs and lows).

- Asset Protection: On hard earned money from risk exposure (liability and seizure).

- Tax Minimization: To minimize tax paid.

- Financial Retirement: Ensure adequate plans and resources for an abundant financial retirement.

- Succession: Create a “salable” business that ensures a successful transition to the next generation of ownership.

- Legacy/Estate: A functional plan to take care of families and accumulated wealth after death.

The Only CPA Firm with a Pricing Guarantee

Our pricing guarantee is simple: If we don’t quote you upfront for the work, we don’t expect you to pay. Whether that’s in our first engagement with you, or it’s in 20 years from now.

You’ll never receive an unpleasant surprise in our invoicing.

“NB Advisors has been a great partner in taking a proactive look at our accounting. They present us with new ideas to help us grow and protect what we have worked so hard to build.”

Bruce Paparone

Founder & CEO of Bruce Paparone Communities

Book Your Free Consultation

If you’re looking to save on your taxes and grow your business, then we’re your trusted Advisors.

Yes, We Offer Outsourced CFO Services in Cities Around Philadelphia, Pennsylvania

Allentown, PA

Bethlehem, PA

Bristol, PA

Chester, PA

Coatesville, PA

Easton, PA

Harrisburg, PA

Hazleton, PA

Lancaster, PA

Lansdale, PA

Lebanon, PA

Norristown, PA

Pottstown, PA

Pottsville, PA

Reading, PA

Scranton, PA

Wilkes-Barre, PA

Williamsport, PA

York, PA

Chester, PA

Erie, PA

Altoona, PA

Johnstown, PA

Harrisburg, PA

Pittsburgh, PA

Wilkes-Barre, PA

Scranton, PA

Easton, PA

Lebanon, PA

Carlisle, PA

CFO Services Philadelphia is near Independence National Historical Park which is close to Ardmore, Conshohocken, and Exton at 1000 S Broad St # 818, Philadelphia, PA 19146. Rittenhouse Square, Citizens Bank Park, and Wells Fargo Center are also nearby.

Other locations we serve:

Cape May

Darby, PA

Montgomery County, PA

South Jersey

Bucks County, PA

Atlantic City

Chester, PA

Kissimmee, FL

Richmond, VA

Wilmington, DE

FAQs

Do most small businesses in Philadelphia do their own accounting?

Most small businesses in Philadelphia tend to handle their own accounting initially to save costs. However, as the business grows, many opt for professional accountants to manage their finances more effectively and comply with tax regulations.

Can you do your own small business accounting?

Yes, you can do your own small business accounting using software like QuickBooks or Xero. However, it requires a solid understanding of financial principles and dedication to keep accurate records and comply with tax laws.

How much do small businesses spend on accounting?

Small businesses typically spend between $1,000 to $5,000 annually on accounting services, depending on the complexity of their finances and the level of service required, such as bookkeeping, payroll, and tax preparation.

What does an accountant do for a small business?

An accountant helps a small business by managing financial records, ensuring tax compliance, providing financial advice, preparing financial statements, handling payroll, and offering strategic planning to improve profitability and cash flow management.

How much should I pay for a good accountant in Philadelphia?

In Philadelphia, you should expect to pay between $100 to $300 per hour for a good accountant, depending on their experience and the complexity of the services required. Fixed monthly fees for comprehensive services can range from $300 to $1,000.

When should you consider getting an accountant?

Consider getting an accountant when your business finances become too complex to manage alone, when you need to ensure tax compliance, during business expansion, or when seeking strategic financial advice to improve business performance.

Who should I consult before starting a business?

Before starting a business, consult a business advisor, an accountant, and a legal advisor. These professionals can help you with business planning, financial projections, legal structure, and compliance with local regulations.

Should I consult an accountant when starting a business?

Yes, consulting an accountant when starting a business is highly recommended. An accountant can help with financial planning, choosing the right business structure, setting up accounting systems, and ensuring tax compliance from the beginning.

Can a CPA value a business?

Yes, a Certified Public Accountant (CPA) can value a business. They have the expertise to perform business valuations, which involve analyzing financial statements, market conditions, and other factors to determine the business’s worth.

How to find a local accountant in Philadelphia?

To find a local accountant in Philadelphia, you can search online directories, ask for recommendations from other business owners, check with professional organizations like the Pennsylvania Institute of CPAs, or use services like Yelp and Google Reviews.

1 Interesting & 1 Fun Fact About Philadelphia

Philadelphia, known as the “City of Brotherly Love,” is home to the world-famous Liberty Bell, an enduring symbol of American independence and freedom. Housed in the Liberty Bell Center, it attracts millions of visitors annually who come to see its iconic crack and learn about its storied past.

Another fun fact about Philadelphia is its rich culinary heritage, notably as the birthplace of the Philly cheesesteak. This beloved sandwich, made with thinly sliced beef, melted cheese, and often onions, was invented in the 1930s by Pat Olivieri. Today, Pat’s King of Steaks and its rival, Geno’s Steaks, both located in South Philadelphia, are famous for serving up this local delicacy, drawing food enthusiasts from around the globe to taste the authentic Philly cheesesteak experience.

Philadelphia Small Business Accounting Resources

1401 John F Kennedy Blvd

Philadelphia, PA 19102

(215) 686-1776

20 Erford Rd

Lemoyne, PA 17043

(800) 270-3352

What is the Pennsylvania Institute of CPAs?

The Pennsylvania Institute of Certified Public Accountants (PICPA) is a professional organization that represents over 20,000 CPAs and accounting professionals in Pennsylvania. Founded in 1897, its mission is to enhance the success of its members and foster high standards in the accounting profession through advocacy, education, and networking. PICPA provides a wide range of services, including continuing professional education, industry updates, and resources to help members stay current with regulatory changes and best practices. Additionally, it advocates on behalf of CPAs at both the state and national levels, ensuring the profession’s interests are represented in legislative matters.

What is the Pennsylvania State Board of Accountancy?

The Pennsylvania State Board of Accountancy is a governmental agency responsible for regulating the practice of public accounting within Pennsylvania. Its primary functions include licensing and renewing licenses for Certified Public Accountants (CPAs) and public accounting firms, establishing and enforcing professional standards, and ensuring compliance with the state’s accountancy laws and regulations. The board investigates complaints, conducts disciplinary hearings, and can impose sanctions to maintain the integrity of the profession. By overseeing the qualifications and practices of accounting professionals, the Pennsylvania State Board of Accountancy aims to protect the public interest and ensure the competence and ethical conduct of CPAs in the state.

Philadelphia, PA Local Resources

The Chamber of Commerce for Greater Philadelphia

200 S Broad St #700

Philadelphia, PA 19102

(215) 545-1234

Philadelphia Office of the Director of Finance

1401 John F. Kennedy Blvd.

Room 1330

Philadelphia, PA 19102

(215) 686-6141

Philadelphia IRS Taxpayer Assistance Center

600 Arch St

Philadelphia, PA 19106

(844) 545-5640

Philadelphia Police Department

750 Race St

Philadelphia, PA 19106

(215) 686-1776

City of Philadelphia

1400 John F Kennedy Blvd

Philadelphia, PA 19107

(215) 686-1776

Top Companies in Philadelphia, PA

Comcast Center 1701 JFK Boulevard

Philadelphia, PA 19103

(215) 583-8078

More About Small Business Accounting in Philadelphia, Pennsylvania

Philadelphia, the largest city in Pennsylvania, boasts a population of over 1.6 million people, making it the sixth-most populous city in the United States. The city’s demographic profile is diverse, with roughly 40% of residents identifying as Black or African American, 34% as White, and 15% as Hispanic or Latino. The Asian community represents about 7% of the population, reflecting Philadelphia’s rich multicultural fabric. This diversity is evident in the city’s vibrant neighborhoods, each offering a unique cultural experience, from the historic African American communities in North Philadelphia to the bustling Asian markets in Chinatown.

The residents of Philadelphia, often referred to as Philadelphians, are known for their strong sense of community and pride in their city’s history and traditions. The city’s median age is approximately 34 years, highlighting a balanced mix of young professionals, families, and older adults. Education levels vary, with several prestigious universities, including the University of Pennsylvania and Temple University, attracting students from around the world. Philadelphia’s workforce is diverse, with significant employment in healthcare, education, and the service industry. Despite challenges such as poverty and crime, the resilient spirit of its residents continues to drive Philadelphia’s ongoing growth and revitalization.

Philadelphia CPA firms are crucial for the city’s vibrant entrepreneurial ecosystem. Many small businesses, from quaint cafes in Rittenhouse Square to innovative tech startups in University City, rely on precise accounting to ensure financial health and compliance. Local small business accountants in Philadelphia offer services tailored to small businesses, including bookkeeping, tax preparation, and financial consulting. These services help business owners manage cash flow, track expenses, and prepare for tax season, thereby facilitating informed decision-making and strategic growth.

Philadelphia’s small business accountants also assist with navigating local and state tax regulations, which can be complex. They provide guidance on tax deductions, credits, and incentives specific to Pennsylvania and Philadelphia, such as the Keystone Opportunity Zone program. Additionally, Philadelphia CPA firms often advise on financial planning and risk management, ensuring businesses are prepared for unexpected challenges. With the support of skilled small business accountants in Philadelphia, business owners can focus on their core operations, confident that their financial matters are in expert hands. This professional support is essential for fostering a thriving small business community in the city.

NB Advisors, LLC works with small businesses to minimize their tax burden and grow their profits. Offering tax planning and accounting services in the greater Philadelphia area, we work proactively for you. Our clients love our quick response time, fixed fees, and our innovative solutions.

Your Next Steps

Request a Consultation |  |

We’ll review your immediate needs and provide a course of action to help you save money on taxes and grow your business.

Get Your Free Guide |  |