Outsourced Orlando CFO Services – Increase Your Profits by 954.9%?

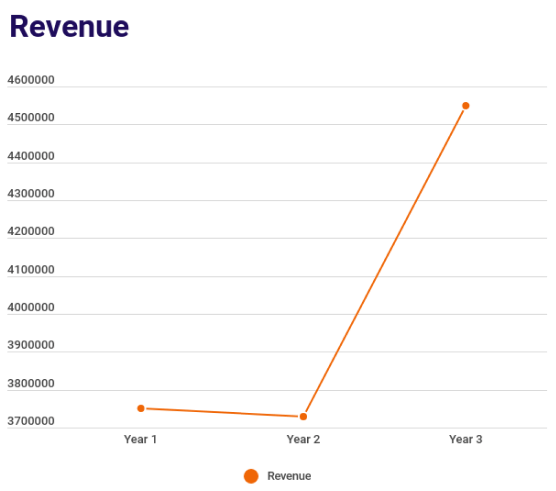

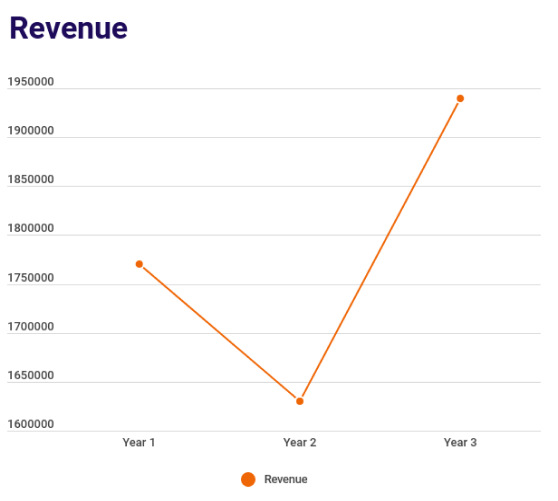

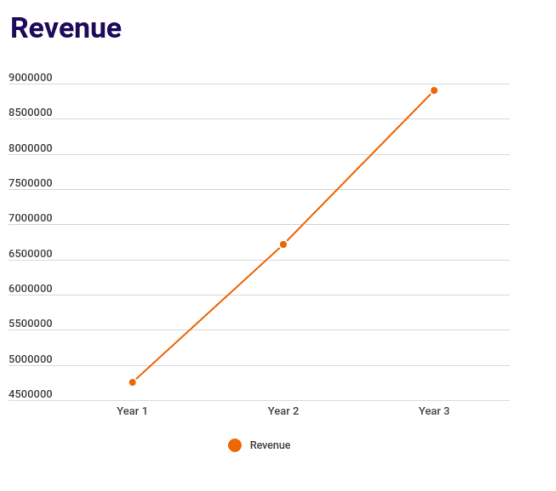

For 35+ years, we’ve been providing premier CFO virtual services for American business owners, and we’re damn-good at what we do. On average, we increase revenue by 40.1% ($2.3M) and profits by 954.9% ($1.8M) over 3 years.

Serving the Orlando area’s 1,776,841 residents and 105,737 businesses spanning Lake Nona, Baldwin Park, Audubon Park, and beyond for all of your Orlando Small Business Accountant needs.

How One Small Business Owner in Philadelphia Unlocked $1M in Capital

Discover How 3 of Our Clients Benefitted From Our CFO Advisory Services

By teaming up with us and receiving insightful data and creative strategic solutions, the following three clients were able to make better decisions and increase their profits substantially (avg 954.9%).

CFO = 10x Revenue & 4x Profits

We analyzed the financials of our outsourced CFO clients and found…

Companies that did not use CFOs

- Their average annual revenue was $1.2M

- Their average annual profits were $310K

- Worst of all, these Business Owners were prone to working 60+ hour work weeks

Companies that used an outsourced CFO

- Their average annual revenue was $10.7M

- Their average annual profits were $1.1M

- Best of all, the Owners worked less as they relied on their teams and employees to achieve results

Our CFO Services Are Perfect for You, IF…

You don’t know what a CFO does?

- If you’re trying to grow your business without a CFO (Chief Financial Officer) it would be like trying to fly from NYC to LA, but without any instruments or a map.

- As your CFO, we’ll act as your navigator and strategically guide you through the financial data to help you (the CEO) pilot the company to your revenue goals.

- Note, a CFO (Chief Financial Officer) is not just another accountant who calculates numbers; a CFO is a partner who communicates the prioritization of creative solutions.

You realize you need a CFO

- You want a CFO to alert you to foreseeable trouble (cashflow), make financial decisions (on labor costs), and “gut check” your decisions, but…

- You can’t justify the $150,000 to $500,000 salary of a full-time CFO.

- The solution is our on-demand CFO services because we can provide the high-level strategic advisory required to achieve your growth goals, but at a fraction of the cost of a salaried executive.

4th Generation Small Business Owners & Accountants

My grandfather was an Accountant and my other grandfather was in the insulation manufacturing industry. Doing great accounting work is in my blood.

Since 1989, my father (Kevin Niedoba), a small business accountant of 30+ years founded our family accounting firm. A few years back, I decided to split my time as a small business owner and join him because I’m passionate about both accounting and entrepreneurship. I hope one day my son, William, will also join the business (if he wants to, he’s only 3 years old).

We’ll treat your business like it’s our own, by taking advantage of every possible legal tax minimization and profitable growth opportunity we can, all the while minimizing risks.

On behalf of my family and our amazing team at NB Advisors, I look forward to working with you to grow your business.

Ryan Niedoba | NB Advisors

Managing Partner

Kevin Niedoba, CPA | NB Advisors

Managing Partner

Trusted by Orlando Small Business Owners

Why Only 6% of Businesses Grow by 300%

Did you know that only 6% of businesses set annual goals and revisit them on a quarterly basis?

This is according to Xero’s (second largest accounting software) “Make or Break” report, which goes further to share that the 6% of business owners that “revisited” their goals quarterly had an increase of 300% in both productivity and performance.

Our Claimed Awards

2018

NJBA:

Best Online Interactive Tool Award

2016-17

SNJBP:

Readers’ Choice Award

2016

NJBA:

Sales and Marketing Excellence Award

2015

Thomson Reuters:

The Rookie of the Year Award

Photo Credit:

Thomson Reuters. Ryan Niedoba (middle) and Kevin Niedoba (right).

Our Claimed Awards

2018

NJBA:

Best Online Interactive Tool Award

2016-17

SNJBP:

Readers’ Choice Award

2016

NJBA:

Sales and Marketing Excellence Award

2015

Thomson Reuters:

The Rookie of the Year Award

World Class Orlando Controller Services

Our Growth Playbook

We have the exclusive North American license to “Game Plan”; a proprietary management accounting tool.

With this tool, we’ll quickly analyze 100s of financial data points

and produce a report with 13 metrics to predict your company’s health, risk factors both short and long term, and likelihood of bankruptcy.

As certified tax professionals, we’ll evaluate your business’ profitability and compare it to the rest of your company’s industry.

We commonly see companies with gross profitability of 10%-15% when they should be closer to 25% to 28%.

Our focus is on making our customer’s business better, faster, and stronger. This is done via our annual firm-wide “Awesome 8” review and by working with businesses on:

- Growth: Strategies to increase revenue and size of the business.

- Profitability: How to yield more profit per dollar.

- Cash Flow: Better manage cash flow (highs and lows).

- Asset Protection: On hard earned money from risk exposure (liability and seizure).

- Tax Minimization: To minimize tax paid.

- Financial Retirement: Ensure adequate plans and resources for an abundant financial retirement.

- Succession: Create a “salable” business that ensures a successful transition to the next generation of ownership.

- Legacy/Estate: A functional plan to take care of families and accumulated wealth after death.

The Only CPA Firm with a Pricing Guarantee

Our pricing guarantee is simple: If we don’t quote you upfront for the work, we don’t expect you to pay. Whether that’s in our first engagement with you, or it’s in 20 years from now.

You’ll never receive an unpleasant surprise in our invoicing.

“NB Advisors has been a great partner in taking a proactive look at our accounting. They present us with new ideas to help us grow and protect what we have worked so hard to build.”

Bruce Paparone

Founder & CEO of Bruce Paparone Communities

Book Your Free Consultation

If you’re looking to save on your taxes and grow your business, then we’re your trusted Advisors.

Yes, We Offer Small Business Accounting in Orlando, Florida

Altamonte Springs, FL

Apopka, FL

Avon Park, FL

Bartow, FL

Bay Lake, FL

Belle Isle, FL

Clermont, FL

Cocoa, FL

Cocoa Beach, FL

Davenport, FL

Daytona Beach,FL

DeLand, FL

Eustis, FL

Haines City, FL

Kissimmee, FL

Lake Buena Vista,FL

Lake Mary, FL

Leesburg, FL

Maitland, FL

Melbourne, FL

Mount Dora, FL

Ocala, FL

Ocoee, FL

Port Orange, FL

Sanford, FL

St. Cloud, FL

Titusville, FL

Umatilla, FL

Winter Garden, FL

Winter Park, FL

Small Business Accountant Orlando is near Universal Studios Florida which is close to Baldwin Park, Celebration, and Oviedo at 6236 Marina Dr, Orlando, FL 32819. Kia Center, The Florida Mall, and Lake Eola Park are also nearby.

Other locations we serve:

Cherry Hill

Hammonton

Pittsburgh

Vineland, NJ

Bucks County, PA

Atlantic City

Chester, PA

Kissimmee, FL

Richmond, VA

Wilmington, DE

FAQs

Is it worth it to hire an accountant for a small business in Orlando?

Yes, hiring an accountant can be worth it for a small business in Orlando. They provide expertise in tax laws, financial planning, and can save time and money, allowing business owners to focus on core operations.

What type of accountant is best for small business?

A Certified Public Accountant (CPA) is best for small businesses. CPAs offer comprehensive services including tax preparation, financial planning, and auditing, ensuring compliance with state and federal regulations.

How does small business accounting work?

Small business accounting involves tracking income and expenses, managing payroll, preparing financial statements, and ensuring tax compliance. It uses accounting software to automate and simplify these tasks.

How many accountants should a small business have?

Typically, one accountant or a small accounting firm is sufficient for a small business. Larger businesses with complex needs might require additional accountants or a dedicated accounting department.

At what point should a business in Orlando get an accountant?

A business should consider getting an accountant at the startup phase for initial setup, during tax season, and as the business grows to manage increasing financial complexity.

What are the disadvantages of hiring an accountant?

The main disadvantages include the cost of hiring an accountant and potential over-reliance on their expertise, which might hinder the business owner’s understanding of their own finances.

Should I talk to a CPA before starting a business?

Yes, consulting a CPA before starting a business can provide valuable insights into tax planning, legal structure, and financial strategies, helping to avoid costly mistakes and ensure a solid financial foundation.

How to select an accountant?

Select an accountant by verifying their credentials, ensuring they have relevant experience, checking references, and confirming their familiarity with your industry. A good rapport and clear communication are also essential.

Do most small businesses do their own accounting?

Many small businesses initially do their own accounting using software, but as they grow, they often hire accountants to handle more complex financial tasks and ensure compliance with tax laws.

Can I do my own accounting for my business in Orlando?

Yes, you can do your own accounting using software like QuickBooks or Xero. However, professional advice might be beneficial for tax planning and compliance as your business grows.

What is the best accounting method for a small business?

The accrual accounting method is often best for small businesses as it provides a more accurate picture of financial health by recording revenues and expenses when they are incurred, not when cash changes hands.

Should I do my own bookkeeping?

You can do your own bookkeeping if your business transactions are simple and few. However, as your business grows, hiring a bookkeeper or accountant can save time and reduce errors.

1 Interesting & 1 Fun Fact About Orlando

Orlando, known as “The Theme Park Capital of the World,” is home to Walt Disney World, the largest and most visited recreational resort globally. Opened in 1971, it spans nearly 25,000 acres and includes four theme parks, two water parks, numerous hotels, and entertainment venues, attracting millions of visitors each year.

Another fun fact about Orlando is its unique history with citrus. Before becoming synonymous with theme parks, Orlando was the hub of Florida’s citrus industry. The area’s warm climate and fertile soil made it ideal for growing oranges, leading to a booming citrus trade in the late 19th and early 20th centuries. Today, visitors can still see remnants of this history in the form of historic orange groves and enjoy freshly squeezed Florida orange juice, celebrating Orlando’s citrus heritage.

Orlando Small Business Accounting Resources

400 South Orange Ave

City Hall, 4th Floor

Orlando, FL 32801

(407) 246-2341

What is the Florida Institute of CPAs?

The Florida Institute of Certified Public Accountants (FICPA) is a professional association dedicated to serving the interests of over 19,500 CPAs in Florida. Established in 1905, FICPA aims to support the CPA profession through advocacy, education, and professional development. It offers various resources such as continuing professional education programs, industry updates, and networking opportunities to help members maintain their expertise and adhere to high ethical standards. The institute also represents the profession’s interests at the state and national levels, ensuring that legislative and regulatory changes support the CPA community and public interest.

What is the The Florida Board of Accountancy?

The Florida Board of Accountancy is a governmental body responsible for regulating and overseeing the practice of public accounting in Florida. It ensures that Certified Public Accountants (CPAs) and accounting firms meet the state’s licensing requirements and adhere to professional standards. The board’s duties include issuing and renewing CPA licenses, setting and enforcing ethical and professional guidelines, and investigating complaints against CPAs and firms. It also conducts disciplinary actions when necessary to uphold the integrity of the profession. By maintaining high standards and ensuring compliance with state laws, the Florida Board of Accountancy works to protect the public and enhance the credibility and competence of the accounting profession in Florida.

Orlando, FL Local Resources

Orlando Economic Partnership

SunTrust Center, 200 S Orange Ave Ste. 200

Orlando, FL 32801

(407) 422-7159

Orlando Office of Business and Financial Services

City Hall 400 South Orange Avenue

Orlando, FL 32801

(407) 246-2121

Orlando IRS Taxpayer Assistance Center

201 S Orange Ave

Orlando, FL 32801

(321) 441-2586

Orlando Police Department

1250 W South St

Orlando, FL 32805

(321) 235-5300

City of Orlando

400 S Orange Ave

Orlando, FL 32801

(407) 246-2121

Top Companies in Orlando, FL

More About Small Business Accounting in Orlando, Florida

Orlando, a city in central Florida, is home to approximately 310,000 residents, making it one of the fastest-growing cities in the state. Known for its world-famous theme parks, including Walt Disney World and Universal Studios, Orlando attracts a diverse population from all over the globe. The city’s demographic makeup is a vibrant mix, with around 42% identifying as White, 32% as Hispanic or Latino, 26% as Black or African American, and 5% as Asian. This diversity is reflected in the city’s rich cultural scene, from its varied culinary offerings to its numerous cultural festivals.

Residents of Orlando, often called Orlandonians, enjoy a high quality of life with a median age of around 34 years, indicating a dynamic blend of young professionals, families, and retirees. The city’s economy is primarily driven by tourism, hospitality, and entertainment, but it also has growing sectors in technology, healthcare, and education. With institutions like the University of Central Florida, Orlando attracts students and academics from around the world. Despite challenges such as traffic congestion and a high cost of living in some areas, the residents’ strong community spirit and the city’s continuous development contribute to its appeal as a vibrant place to live and work.

Small business accounting in Orlando is essential for the city’s dynamic entrepreneurial landscape, which spans from innovative tech startups to bustling hospitality ventures. Local small business accountants in Orlando provide a range of services tailored to small businesses, including bookkeeping, tax preparation, payroll management, and financial consulting. These services help business owners maintain accurate financial records, comply with tax regulations, and optimize their financial strategies. Orlando CPA firms play a crucial role in helping businesses manage their finances effectively, ensuring sustainability and growth in a competitive market.

Orlando small business accountants are adept at navigating both federal and Florida-specific tax laws, offering guidance on state sales tax, employment taxes, and local business tax requirements. They assist businesses in leveraging tax deductions and credits available to them, such as those related to tourism and technology. Additionally, Orlando CPA firms provide valuable insights into financial planning, cash flow management, and risk mitigation. This professional support allows small business owners to focus on their core operations and strategic initiatives, confident that their financial affairs are handled proficiently. With the expertise of skilled small business accountants in Orlando, small businesses can thrive, contributing to the city’s economic vitality and diversity.

NB Advisors, LLC works with small businesses to minimize their tax burden and grow their profits. Offering tax planning and accounting services in the greater Orlando area, we work proactively for you. Our clients love our quick response time, fixed fees, and our innovative solutions.

Your Next Steps

Book a Free Consult |  |

We’ll review your immediate needs and provide a course of action to help you save money on taxes and grow your business.

Read the Case Study |  |